Conversion or Guaranteed Acceptance personal health plan?

Transitioning from a group health plan to a personal plan can be a pivotal moment, and understanding the available options is crucial. In this shift, two key types of personal health plans emerge: Conversion personal health plan and the Guaranteed Acceptance personal health plan.

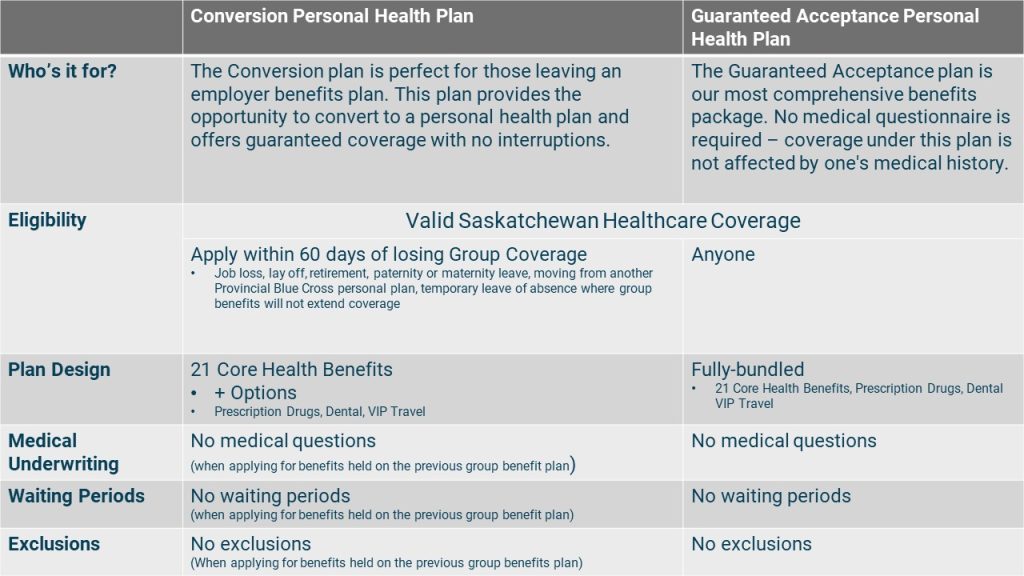

The Conversion personal health plan offers continuity of coverage by allowing individuals to seamlessly transition from their group plan to a personal one, without the need for medical underwriting for benefits held on the group plan. This means pre-existing conditions are typically covered, ensuring uninterrupted access to necessary healthcare services. It provides a bridge, maintaining the benefits and coverage one had under the group plan while moving into a personal insurance product.

On the other hand, a Guaranteed Acceptance personal health plan, as the name suggests, assures coverage without the requirement of medical underwriting. It offers a safety net for individuals who may not qualify for traditional health insurance due to pre-existing conditions or other health-related factors. This type of plan eliminates the possibility of being denied coverage based on health status, providing essential healthcare access to those who need it most.

While both options cater to individuals transitioning from group plans to personal ones, they differ in their approach to plan design and medical underwriting.

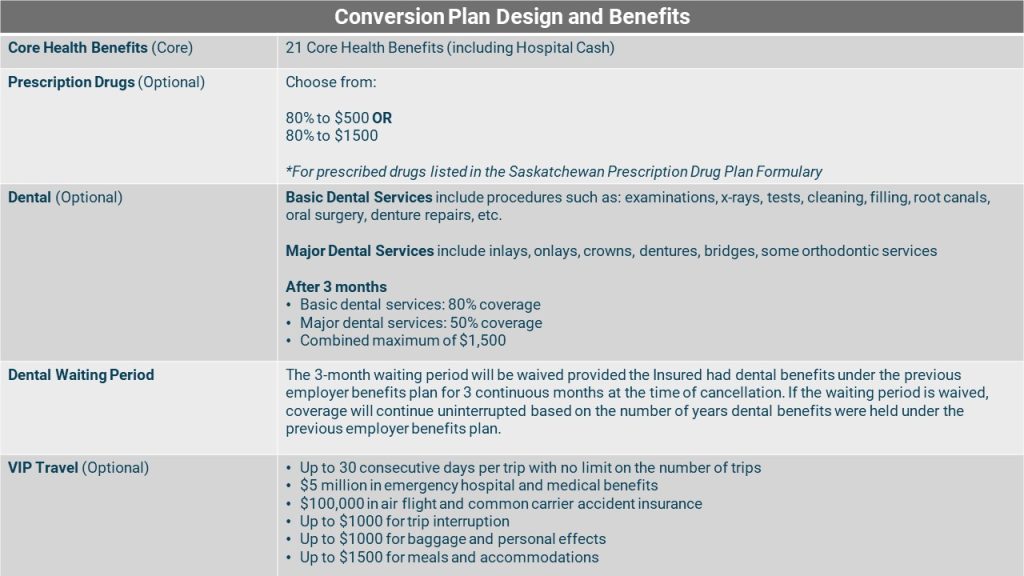

Plan Design

Each Conversion plan starts with 21 Core Health benefits. Applicants can choose to customize their plan by adding or applying for custom options, depending on their personal needs and budget.

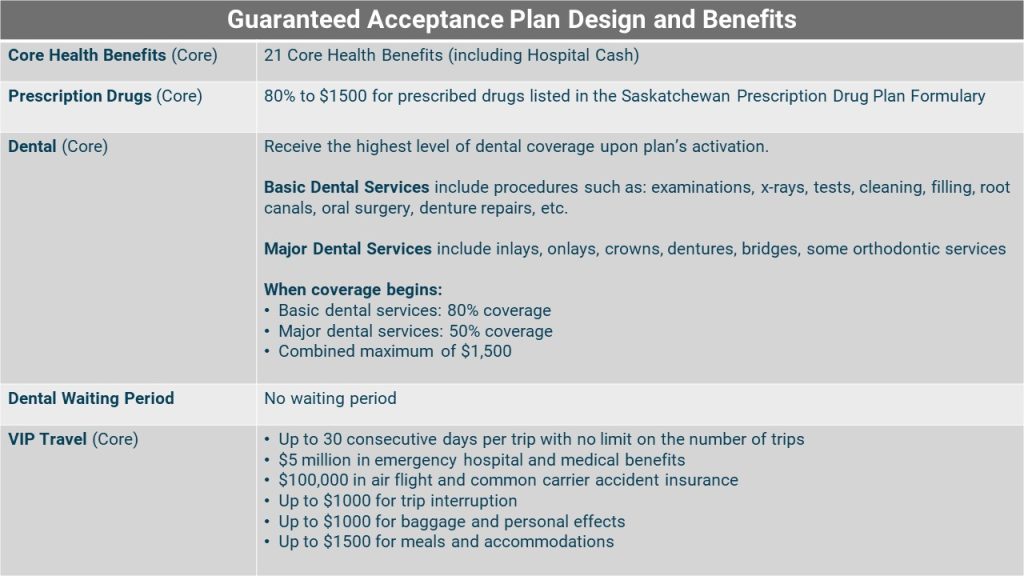

Alternatively, the Guaranteed Acceptance plan is our most comprehensive, fully bundled package including:

- 21 Core Health benefits

- Prescription drugs

- Dental and,

- VIP travel coverage

Medical Underwriting

The Conversion plan prioritizes continuity and ease of transition, maintaining coverage levels from the previous plan. In some instances, medial underwriting may be required if a medically underwritten benefit was not held under the group plan, but the coverage is desired to be held on the Conversion plan.

Meanwhile, the Guaranteed Acceptance plan emphasizes accessibility, ensuring that all individuals, regardless of health status, have the opportunity to secure vital healthcare coverage.

Understanding these differences empowers individuals to make informed decisions tailored to their unique healthcare needs.

Compare personal health insurance plan designs and benefits here.

For more information about our Saskatchewan Blue Cross Personal Health Plans, please visit the Saskatchewan Blue Cross Personal Health Plans course located within your Advisor Learning Centre. If you don’t have an account, request access here.