Personal health insurance

Your health insurance needs are as unique as you. With a Personal Health Plan that’s customized to meet your needs, you can feel confident knowing you and your family are protected against unexpected medical expenses.

Personal Health Plans

Fill the gaps in your provincial or workplace benefits with a customizable health insurance plan from Saskatchewan Blue Cross.

Health insurance plans

Health insurance plans

Blue Choice® plan details

Whether you’re an individual, a couple or a family, our plans are designed with you in mind. Customize your health coverage with optional benefits to make sure your plan fits you perfectly.

- Comprehensive coverage

- Affordable

- Medical questionnaire

Basic plan Every plan comes with 20 core benefits.

Custom options Customize your plan with any or all of the following benefits.

Conversion plan details

Leaving a workplace benefits plan? Apply within 90 days of your coverage end date to convert your coverage to keep you and your family protected. You’ll have guaranteed coverage with no waiting period for your health insurance benefits.

- Guaranteed coverage when applying within 90 days from leaving an employer benefits plan

- No waiting period

- No medical questionnaire

Basic plan Every plan comes with 20 core benefits.

Custom options Customize your plan with any or all of the following benefits.

Guaranteed Acceptance plan details

Enjoy total health coverage, with no medical questionnaire required. Guaranteed Acceptance provides core health benefits, prescription drugs, dental, VIP travel, and optional Student Accident coverage.

- No medical questionnaire

- Guaranteed coverage

- No waiting period

- Total health coverage

Every plan includes these core benefits

Retiree plan details

Retire with confidence: three levels of coverage to choose from — Basic, Classic, or Enhanced.

With optional benefits and 36 possible plan combinations, you can tailor your plan to match your needs. This plan is available to those aged 50+ who are approaching retirement or have recently left a group benefits plan. To be eligible, coverage must begin within 90 days of the end of your group benefits.

- Guaranteed coverage

- No waiting period

- Tailored coverage

3 Levels of Coverage: Basic, Classic, and Enhanced Choose from three coverage levels across each benefit category — Basic, Classic, or Enhanced — all of which include Extended Health with VIP Travel and Prescription Drug coverage.

Custom Options: Customize your plan by adding dental coverage and choose from three plans levels – Basic, Classic, or Enhanced.

Member Benefits

Virtual healthcare and mental health support for members

Included with every plan, in collaboration with Homewood Health and Cleveland Clinic Canada.

Individual Assistance Program (IAP)

Coverage provides access to a variety of mental health and wellness supports. Homewood Health’s IAP provides confidential, professional services for a broad range of personal and family challenges by telephone, in person and online.

Virtual Care

Coverage provides access to virtual care services through Cleveland Clinic Express Care Online (ECO). ECO connects members with a Cleveland Clinic Canada nurse practitioner to receive a diagnosis and/or prescription for non-emergency medical conditions. Members can seek virtual care support as often as needed.

Blue Advantage®

Even with extended health coverage, sometimes you may need to pay for health and dental products and services. With your personal health insurance plan from Saskatchewan Blue Cross, you can save on healthcare-related products and services at participating providers across Canada, even if they aren’t covered under your benefits plan!

How it works

Blue Advantage provides savings on the total cost of products and services from participating providers. Members can present their Blue Cross ID card and mention the Blue Advantage program to their provider to receive the discount. Click below to view the complete list of participating providers and eligible savings.

Earn rewards for referring friends and family

As a valued member, you can earn rewards for referring your friends and family to Saskatchewan Blue Cross. When someone you refer signs up for a personal health plan, both you and the person you refer will be eligible for a referral reward!

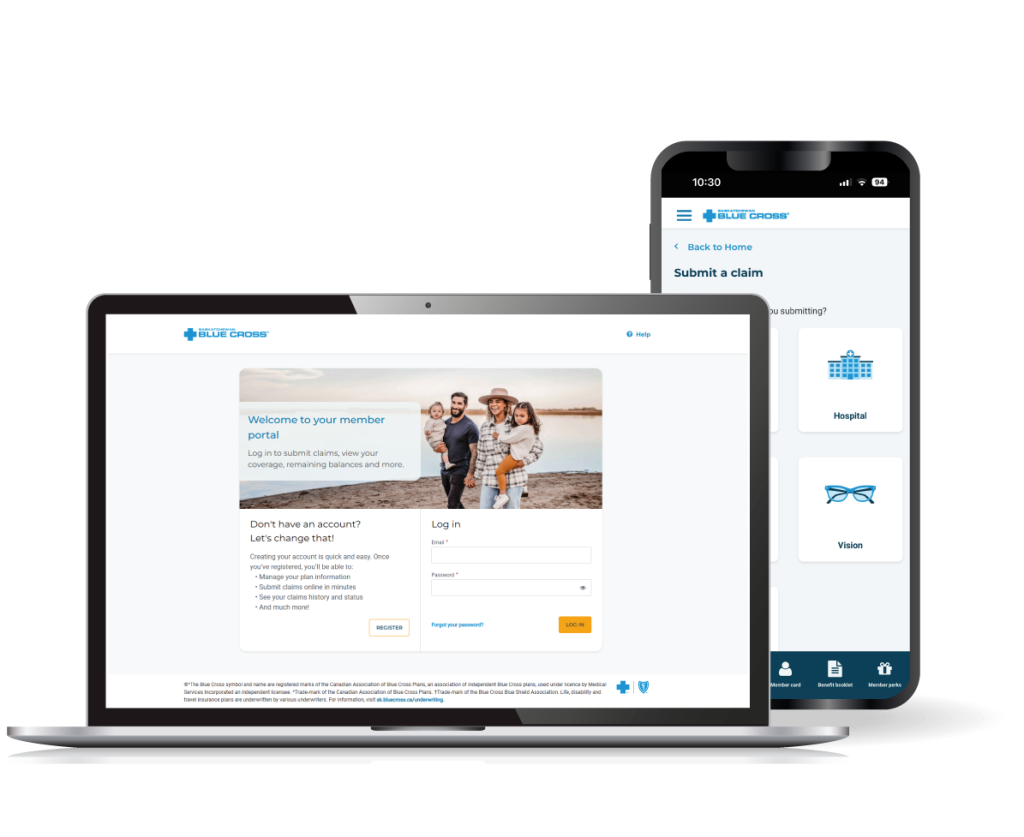

Managing health coverage has never been easier.

Members can manage your group benefits plan using the Saskatchewan Blue Cross Member Portal or Member App. You’ll enjoy convenient claiming, quick reimbursement direct to your bank account, plus access to details including plan maximums, coverage limitations, and plan usage.

Get the SK Blue Cross Member App

The SK Blue Cross Member App supports devices operating on the following operating systems: Apple iOS: Version 15.4 and higher. Android: Version 10 and higher.

Tools

Build your knowledge

Explore topics to help you make decisions about the insurance you need.

Explore FAQs

Answers to your questions about insurance coverage, managing your plan, and more.

Frequently Asked Questions

How do I know which plan or options are right for me?

Our dedicated team can help you understand and choose the coverage you need, no matter what stage of life you’re in.

Who is considered a dependent?

For Personal members: An applicant’s partner, unmarried child up to 18 years of age (or up to age 25 if a full-time student at an accredited educational institution) or an incapacitated dependent.

For Group plan members: An applicant’s partner, unmarried child up to 21 years of age (or up to age 26 if a full-time student at an accredited educational institution) or any disabled child unable to leave the care of the policyholder.