Single-Trip

The Single-Trip Plan offers the perfect coverage for travelers taking one trip a year. Customize your plan to fit your needs by selecting only the coverage you want.

Available Coverage:

Customize your plan with any or all available coverage options.

| Available Coverage | |

|---|---|

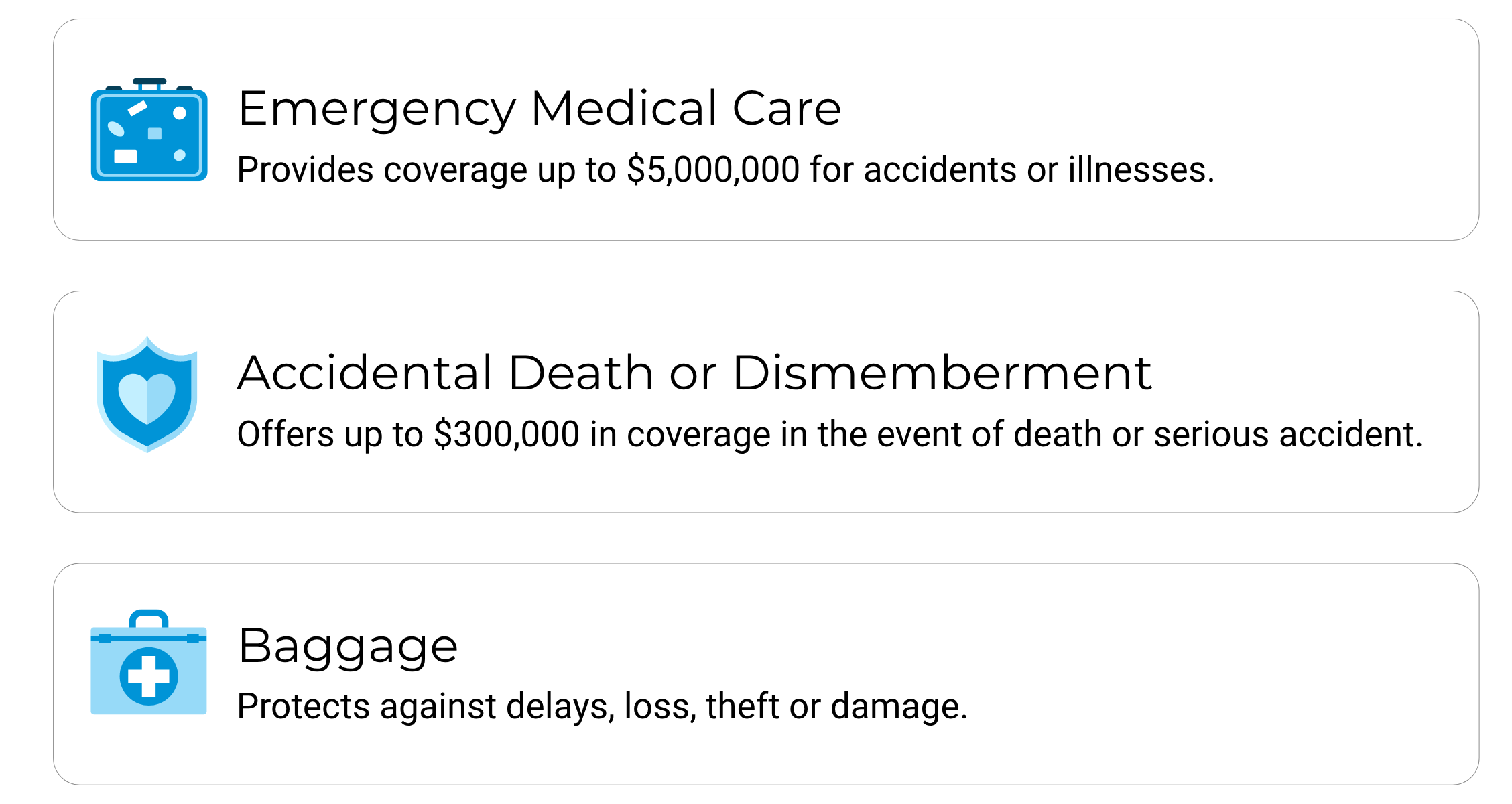

| Emergency Medical Care* | Optional add-on |

| Trip Cancellation and Interruption** | Optional add-on |

| Trip Interruption | Optional add-on |

| Baggage | Optional add-on |

| Accidental Death or Dismemberment | Optional add-on |

| Flight Delay Service | ✓ |

| Blue Cross Travel Assistance | ✓ |

*Optional Add-On: Reduced Stability Period available to those aged 55–59 and travelling for 18 days or more, or aged 60–84 regardless of trip length. This optional coverage reduces the required stability period from 6 months to 3 months prior to trip departure for pre-existing medical condition coverage.

**Optional Add-On: Cancel for Any Reason available when you buy Trip Cancellation and Interruption insurance. This add-on allows you to change plans, without the worry of losing non-refundable expenses. No explanations needed—just pure travel flexibility.