Single-Trip

The Single-Trip Plan offers the perfect coverage for travelers taking one trip a year. Customize your plan to fit your needs by selecting only the coverage you want.

Available Coverage:

Customize your plan with any or all available coverage options.

| Available Coverage | |

|---|---|

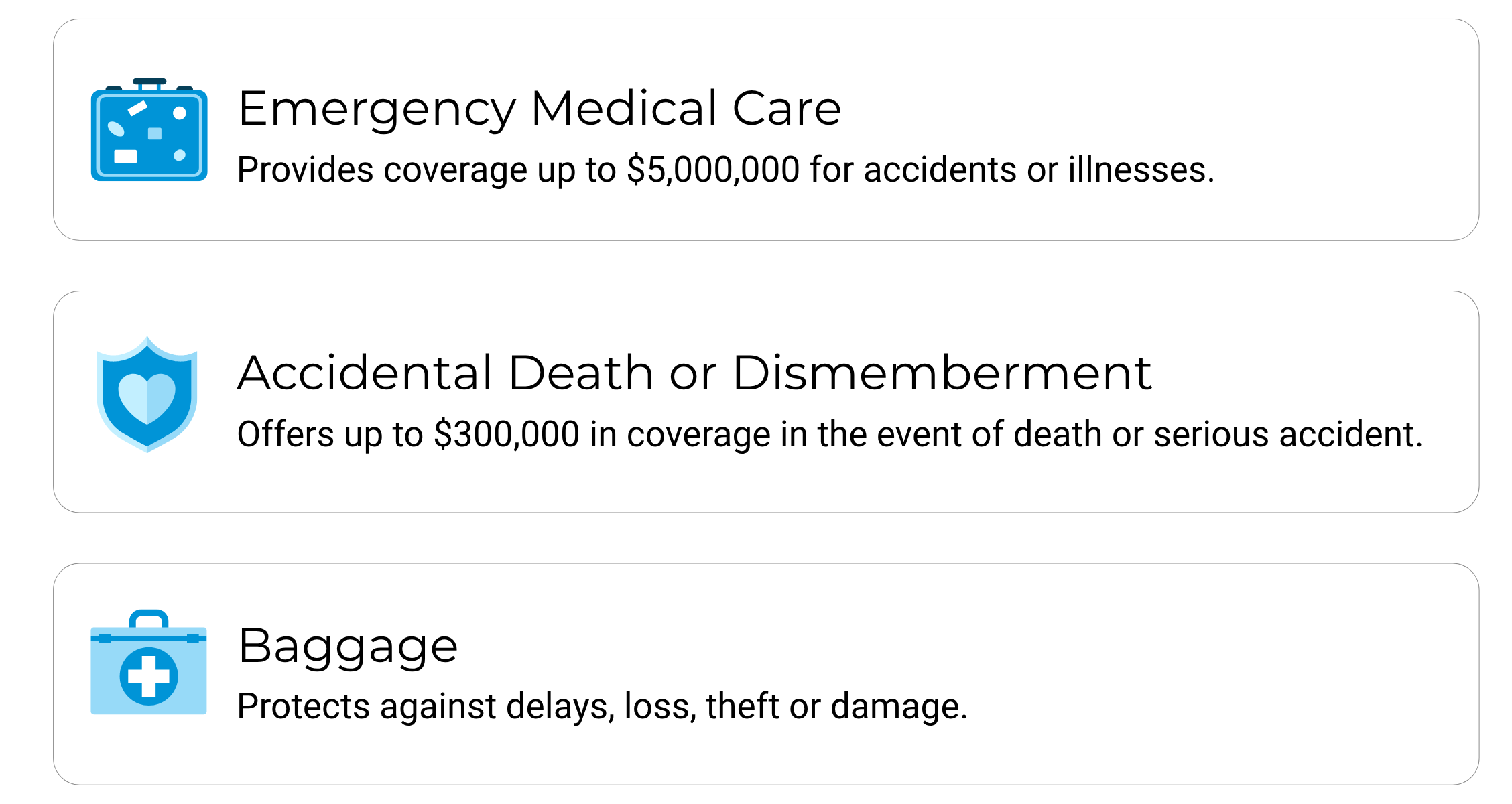

| Emergency Medical Care | Optional add-on |

| Trip Cancellation and Interruption* | Optional add-on |

| Trip Interruption | Optional add-on |

| Baggage | Optional add-on |

| Accidental Death or Dismemberment | Optional add-on |

| Flight Delay Service | ✓ |

| Blue Cross Travel Assistance | ✓ |

*Optional Add-On: Cancel for Any Reason available when you buy Trip Cancellation and Interruption insurance. This add-on allows you to change plans, without the worry of losing non-refundable expenses. No explanations needed—just pure travel flexibility.